arkansas estate tax statute

5013408500 Contact Us Google Map. The Maryland breach of contract statute of limitations on oral and written contracts is three years.

Arkansas Governor Signs Accelerated Tax Cuts School Safety Funding Into Law

How to Remove a Debt When the Statute of Limitations Expires.

. To do so the finder must take definite steps to show their claim. Maximum 18-16-304 Landlord may not charge in excess of two 2 months rent to the tenant. As a debtor you can also file a claim of exemption if the creditor tries to levy or garnish any asset of yours other than your wages.

Abandoned property is defined as personal property left by an owner who intentionally relinquishes all rights to its control. May 02 2022 4 min read. The states adverse possession law for instance allows individuals with no official ownership stake to claim ownership of an otherwise underutilized property after seven years if the possession is.

How to Clean Up Even the Worst Credit Report Items. That party may then file a judgment lien in the land records which is a lien that attaches to your real estate. State Statute 26-1-101 requires these to be assessed on Personal Property - Vehicles - Boat Motor Trailer.

Property Tax Compliance Form. The Fair Housing Act prohibits discrimination in most residential real estate-related transactions. Special estate tax liens applicable to cases involving certain closely held business or farm or qualified family-owned business property are provided for by IRC 6324A and IRC 6324B.

Fraud claims are covered under the same statute of limitations as negligence claims. What the 7-Year Mark Means. The Internal Revenue Service IRS imposes an estate tax on the value of all of an estates assets at the time of death.

Estates valued under that threshold do not pay estate tax and no IRS filing is required. However claims based on a contract under seal may be filed for 12 years. Personal Property - Under Arkansas law ACA.

Learn more about living trusts in May 02 2022 4 min read. See Code of Civil Procedure section 704010 for a list of what you need to put in a claim of exemption. Additional benefits may apply to those who are 100 disabled or age 65 or.

The law includes the following provisions. 6 Things That Can Bring Old Debt Back to Life. In accordance with Amendment 79 of the Arkansas Constitution homeowners may be eligible for up to a 375 real estate tax credit on their homestead properties.

Real property may not be abandoned. Cases of Medicaid fraud also have a three-year statute of limitations. Individuals businesses with income tax liability only and out of business entities with any type of tax debt You owe 25000 or less If you owe more than 25000 you may pay down the balance to 25000 prior to requesting withdrawal of the Notice of Federal Tax Lien.

Whats the difference between an estate tax and an inheritance tax. A federal housing law protects tenants from unlawful discrimination in the sale or rental of residential property. 6331i5 6331k3B and 6672c4.

Claim of exemption for. Required Disclosures 1 Lead-Based Paint Disclosure Required for any housing structure built prior to 1978 as the harmful substance may be in prior layers of paint and pose a danger with any cracking or chipping walls. But some liens like property tax liens have automatic superiority over essentially all prior liens.

Market Value - ACA. Certain other negative items like some judgments unpaid tax liens and Chapter 7 bankruptcy can remain on your credit report for more than seven years. Generally the priority of a lien is determined by its recording date.

If the United States files suit and reduces the tax claim to. Welcome to FindLaws section on Arkansas property and real estate laws covering statutes that govern the landlordtenant relationship homestead protection from creditors and more. In 2022 the estate tax exemption is 1206 million dollars.

See also IRM 5119 Collection Statute Expiration. 26-1-101 personal property is defined as Every tangible thing being the subject of ownership and not forming a part of any parcel of real property as defined. You are a qualifying taxpayer ie.

26-26-1202 states that personal property of any description shall be valued at the usual selling price of similar property at the. For example a finder might claim. Real Estate Department staff record various real estate-related documents such as deeds mortgages and leases.

Every taxpayer has a lifetime estate tax exemption. And should you be concerned about the implications of either on your estate plan. At common law a person who finds abandoned property may claim it.

A living trust is a powerful estate planning tool that protects your assets in life and after you pass away.

Arkansas Legislators File Bill To Exempt State Taxes On Unemployment Compensation

The Ultimate Guide To Arkansas Real Estate Taxes

Arkansas Estate Tax Everything You Need To Know Smartasset

Guide To Arkansas Closing Costs In 2021 Newhomesource

Recreational Land For Sale Cherokee Village Arkansas 72529 Price 950 In 2022 Cherokee Village Land For Sale Lots For Sale

Arkansas Estate Tax Everything You Need To Know Smartasset

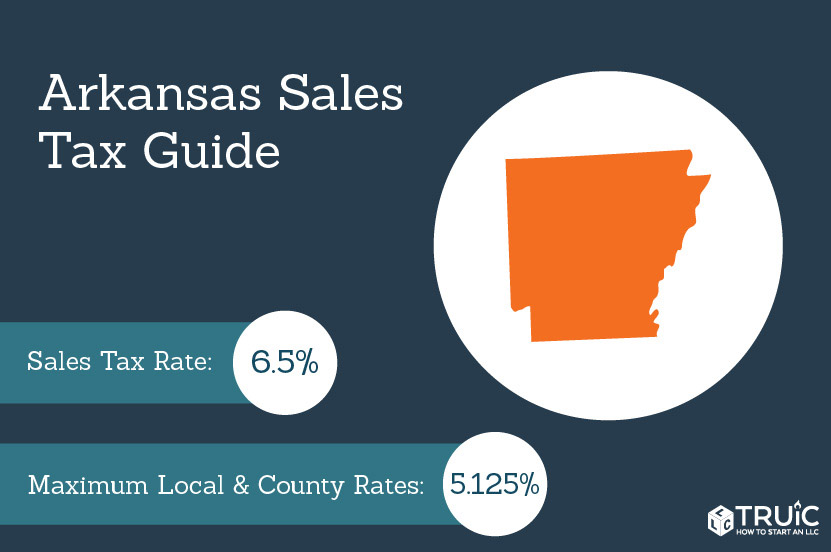

Arkansas Sales Tax Small Business Guide Truic

Is There An Inheritance Tax In Arkansas

White Makes President S List At Southern Arkansas Announcements Tullahomanews Com

Eliminating Its Income Tax Will Help Arkansas S Economy

Tax Legislation For 2022 Arkansas House Of Representatives

Arkansas Quit Claim Deed Form Quites The Deed Arkansas

Arkansas Tax Rates Rankings Arkansas State Taxes Tax Foundation

10 New Laws To Know About In 2022

Planning Family Forests How To Keep Woodlands Intact And In The Family By Thom J Mcevoy 2013 Trade Paperback Large Type Large Print Edition For Sale On Woodlands Large Prints Forest

Arkansas Tax Cuts Arkansas Tax Reform Tax Foundation

Arkansas Inheritance Laws What You Should Know